Every time you look to source your daily consumables from a quick commerce platform, you are offered a host of choices – some are cheaper, while others throw up lucrative combos – and you often end up trying out one of those options, instead of your regular brand.

You are tempted yet again by combo offers and attractive products at affordable rates as you move to check out. The result: You top up your cart with stuff that was not even on your mind when you had logged in.

If brands can be woven into film scripts, then why can’t they be whisked into the quick commerce marketplaces? Impulse is the name of the game, after all.

This subtle form of marketing or advertising goes beyond the usual route of sponsored ads, banners and videos that are listed on these apps. D2C brands and legacy companies rushed in when they spotted the opportunity in quick commerce, going slow on conventional digital media channels like Google and Meta.

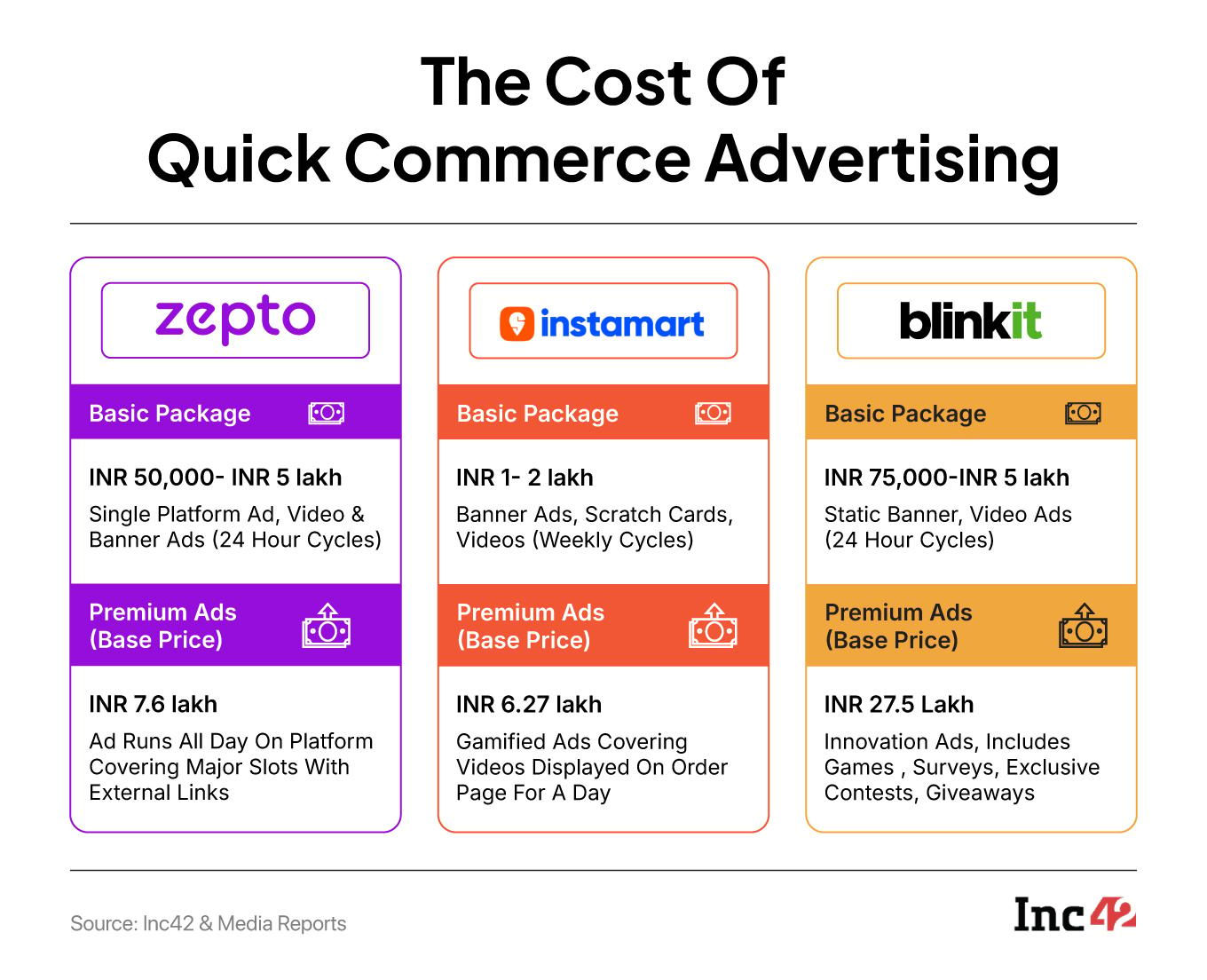

Quick commerce platforms like Instamart, Blinkit and Zepto responded immediately, thrashing out a suite of advertising packages ranging from INR 2-9 lakh for three months to increase visibility for the advertisers, according to media reports.

The strategy is to let a brand onboard various SKUs on a quick commerce platform under a package. The payment is adjusted with the advertisements run for a fixed tenure.

Industry stakeholders believe these apps, known for their fast delivery format, have turned into hotspots for targeted advertising, capitalising on a massive captive audience primed for purchases.

This growing trend has in fact positioned quick commerce as a formidable competitor to traditional digital advertising giants like Meta (Facebook and Instagram) and Google, where escalating cost-per-click (CPC) rates are prompting brands to seek more efficient alternatives.

Does Qcom Deliver Quick Results?The number of people scrolling through quick commerce platforms for their daily supplies of groceries, snacks, and essentials is expected to reach 65 Mn by 2030. For D2C brands and advertisers, this throws up a huge opportunity to boost precision marketing.

The brands follow a natural course along the quick commerce turf to target the consumer segments where clicks and purchases are more likely compared to that in generic digital platforms.

“I think Amazon showed the way when it comes to marketing on ecommerce platforms and they now have a robust advertising business in India. Quick commerce platforms followed naturally. Here, brands can harness first-party data in a closed-loop system to deliver more relevant options, averting a broader coverage in digital advertising,” said GV Krishnamurthy, founder of digital marketing firm AiNxtGen.

“While general digital ads might annoy or miss the mark, advertising on quick commerce platforms thrive by focussing on high-intent shoppers in retail environments, achieving incremental ROI over traditional methods.”

The INR 1.4-1.6 Lakh Cr advertising market is surging at 10-15% a year, with digital advertising making up 50–60% of this kitty. This share is likely to reach INR 1.5-1.7 Lakh Cr by 2029, with small and medium-sized enterprises (SMEs) and direct-to-consumer (D2C) brands emerging as key drivers.

The advent of quick commerce has, in fact, triggered a change in consumer mindset over the past few years. And, D2C brands have zoomed in on the business by allocating 60-70% of their total marketing budget.

“Unlike traditional ecommerce, where discovery can be passive, quick commerce consumers are in a buying mindset and they want it now. That makes them a fertile ground for brand experiments,” Mira Jhala, whose Frogo enables quick commerce for brands, said.

She noted that these platforms are aggressively promoting their ad solutions, often subsidising trials to encourage brands to dive in. For India’s D2C space that’s likely to scale $300 Bn in value by 2030, this has sparked a rush to campaign on Zepto, Instamart, and Blinkit, especially as the festive season unfolds.

Advertising on quick commerce platforms is far more performance-driven than traditional media, according to Prateek Rastogi, who cofounded healthy atta and rice brand Better Nutrition. Unlike TV or print, where impact is measured in reach and impressions, quick commerce ads convert directly into sales at the point-of-intent.

Does Qcom Blitzkrieg Lower Costs?What’s driving high-impulse-driven brands from FMCG, beauty and personal care, wellness and home décor park 60-70% of their marketing budget in quick commerce channels?

“For FMCG staples and daily-use products, the cost per acquisition is often lower than generic digital channels because the consumer is in a ‘buying mindset’. Every rupee spent on in-app visibility, banner placements, sponsored listings, or sampling, translates to measurable sales impact,” Rastogi said.

Besides targeted reach, cost-efficiency and better returns on advertising spends (ROAS) figure high on a brand’s priority list while looking to market products on quick commerce platforms.

“While the absolute ad rates can be higher than Facebook or Google, the ROAS is significantly stronger in quick commerce because of instant cart conversions.”

Advertising on quick commerce has seen a 3-8% conversions for D2C brands, whereas Amazon and Flipkart, where the brands invest the rest of their ad budget, deliver a 5-8% return on ad spend. For Google and Meta, it was reported at mere 1.5-3%, according to Datum Intelligence.

Industry sources said that the ROAS on quick commerce platforms was 2-3 times that of Meta, Google.

As brands tend to benefit more, quick commerce platforms have started upping the ante to squeeze out the maximum from the D2C brands. The founders dubbed this as an imminent challenge.

“They do offer cheaper alternatives to conventional digital advertising tools. But, the rates are also increasing from the last two years when the user base multiplied. This especially holds true for the festive season when the ad rates jump at least 40-50% and soon may become unaffordable to small and new D2C brands,” alerted the founder of a Bengaluru-based athleisure brand which has its products listed on Instamart and Zepto.

There’s a flip side, too. The boom in quick commerce blitz comes with a set of riders.

“Mere listing on quick commerce platforms isn’t enough, especially when your top SKUs too are listed there. You can’t really be assured of better returns, even as the platforms convince us to spend money on advertisements to expect better ROAS and eventually sales conversions,” he added.

According to Jhala, the performance of any brand marketing depends also on the life cycle of the product. “In the initial burst, ROAS is better than Meta or Google. We have seen campaigns on quick commerce delivering 1.5–2 times higher ROAS for the first few weeks. But, the caveat is that it normalises quickly. Once the ‘newness’ fades and competition for keywords within the app rises, it’s no longer cheaper. The sustainable ROAS still depends on the product-platform fit.”

Qcom Garners A Soaring ToplineThe quick commerce boom in India is on course to create a $30-40 Bn opportunity in the next three to five years. And, as the turf simmers, a three-way race to control the nearly-$7 Bn quick economy turns frenetic.

The Qcom Big Three – Eternal-run Blinkit, Swiggy’s Instamart and Zepto – have seen their ad revenues zoom in recent years, driven by high-margin sponsored listings, targeted promotions, and brand partnerships. The result is a sizzling 280% surge in sales over the last two years with a topline of $1 Bn in FY24 alone.

The growing advertisement ecosystem will cushion the trio against high cash burns on operational expenses. Ad revenues started from modest bases in the early years but have exploded as the platforms scaled their user base and ad tools. The annual recurring revenue (ARR) from ads across is reportedly estimated at INR 3,000–3,500 Cr for the three platforms put together.

Zepto CEO Aadit Palicha had earlier said that its advertisement vertical’s ARR surged five-fold over the past year to INR 1,670 Cr ($200 Mn). Blinkit, which has a 45% share of the quick commerce pie, surpassed INR 400 Cr ad revenue in FY24 and reportedly reached INR 1,000 Cr last year. Although Instamart keeps its breakdowns less detailed, it told the shareholders in Q4 FY25 earnings call that the contribution margin has improved significantly.

10-Sec Window On 10-Min Delivery PlatformLike Zepto, Instamart and Blinkit, the D2C brands too are eyeing the wallet share of urban, time-pressed households looking for speed and convenience.

This user segment covers millions in count, from young professionals who value instant delivery over traditional grocery shopping to health-conscious consumers in metros and Tier-I cities who want to try new, premium, or functional food products, and impulse buyers who make last-minute decisions, often adding trending or promoted products to their basket.

The challenge, Rastogi said, remains in garnering visibility in an increasingly crowded marketplace. With thousands of SKUs fighting for limited screen space, smaller brands are at risk of being overshadowed by established FMCG giants with deeper ad budgets, he added.

High dependence on platform algorithms is another challenge for the D2C brands because the discovery of a product often depends on search ranking and sponsored visibility. Moreover, quick commerce offers very little space for storytelling, unlike social media. The D2C brands need to create the narrative so smart that only a thumbnail and a few lines do the job.

“I think the next phase of quick commerce advertising won’t be about cheap reach but about precise targeting. Whoever cracks the creative and presents a contextual relevance in a 10-second decision window will have an upper hand,” Jhala said.

This means D2C brands must innovate with hyper-personalised ads – perhaps AI-driven recommendations based on past orders – to stand out.

Smaller brands are battling growing pressure on their margins from high ad rates, yet, quick commerce unveils a compelling edge over traditional digital routes in the run-up to the festive days. It blends immediacy with precision to drive sales, converting speed into lasting loyalty.

The post Blinkit, Zepto, Instamart Turn Into D2C Ad Hotspots In Festive Season Rush appeared first on Inc42 Media.

You may also like

US crackdown leaves 'deep scar' on economic ties: S. Korean experts

J-K: Indian Army conducts free medical camp at Poonch's Arai village; distributes wheelchairs, sticks to specially-abled

Kalpataru Projects International bags orders worth Rs 2,720 crore

TN govt's Vetri Nichayam scheme to equip youth with industry-focused skills, jobs

Demon Slayer Infinity Castle Arc: Essential Recap for Fans